Friday, June 10, 2011

Financial Cycles article by IMF

Click for the pdf

Pertama holdings[Harvey Norman]trading halted

The price offered to minority shareholders[the 13%] will the the premium offered + 5-day volume weighted average share price before trading halted.

Lets make an assumption

premium = 10-20%

5-day volume weighted average share price = guess its around 0.56-0.57(too lazy to do the maths)

the thereotical exit price based on above assumption will be around 0.616 to 0.684..close to the price[$0.65] Harvey Norman bought out a shareholder who own a huge block of shares.

Monday, June 6, 2011

Pertama holdings[Harvey Norman]may be privatized

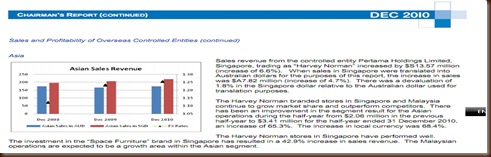

A flurry of activities recently by the Holding Company in Australia to consolidate its shareholdings cheered its shareprice.

A privatization is in the cards, because

1) The holding company and family trust controls almost 70% after bought out 17% from a key shareholder for $0.65 a piece. Plus around 9% by FMR LLC, the public shareholding is less than 13%. The company will also need to buyout the 40 % shareholder in Harvey Norman Ossia from Ossia International Ltd.

2)Pertama Holdings’s profits recovered in 2010 after the financial crisis. Profits even increased last quarter despite having opened a new outlet in 1 Mont Kiara which costed between RM5-10 million.

3)Harvey Norman Holdings has bought out some associates’ interest in Australia. It has also bought out 30% share in a company in Malaysia from a shareholder.